#Create pay stub template

Explore tagged Tumblr posts

Text

Pay Stub Sample Template vs. Paystub Generator: Which One is Better?

When it comes to payroll documentation, businesses and self-employed individuals often choose between a pay stub sample template and a paystub generator. Both options help create professional and accurate pay stubs, but which one is the better choice for your needs?

In this article, we’ll explore the differences, advantages, and drawbacks of using a pay stub sample template versus a paystub generator. By the end, you’ll have a clear understanding of which option best suits your business requirements.

What is a Pay Stub Sample Template?

A pay stub sample template is a pre-designed document that helps businesses manually enter payroll details. It is typically available in formats such as Word, Excel, or PDF and includes necessary payroll information such as gross pay, deductions, and net earnings.

Pros of Using a Pay Stub Sample Template

✅ Customizable – Users can modify the template according to their specific needs.

✅ Free or Low Cost – Many sample templates are available for free or at a low cost.

✅ Easy to Use – Requires basic knowledge of payroll calculations but is straightforward to fill out.

✅ Good for Small Businesses – Ideal for small businesses with a limited number of employees or self-employed individuals.

Cons of Using a Pay Stub Sample Template

🚨 Manual Calculations – Users must calculate taxes, deductions, and net pay manually.

🚨 Risk of Errors – Without automation, mistakes in calculations can occur.

🚨 Time-Consuming – Filling out multiple pay stubs manually can take a lot of time, especially for growing businesses.

What is a Paystub Generator?

A paystub generator is an online tool that automatically creates pay stubs by calculating earnings, taxes, and deductions. Users input their details, and the generator instantly produces a professional pay stub.

Pros of Using a Paystub Generator

✅ Automated Calculations – The tool calculates taxes and deductions accurately, reducing human error.

✅ Saves Time – Generates pay stubs within minutes.

✅ Professional Format – Creates well-structured and polished pay stubs.

✅ Cloud-Based Access – Many generators allow users to store and access pay stubs online.

Cons of Using a Paystub Generator

🚨 Costs Money – Many generators require payment for each pay stub or a subscription fee.

🚨 Limited Customization – Some generators have restrictions on format and layout.

🚨 Potential Security Risks – Users must ensure they use a trusted and secure generator to protect sensitive payroll data.

Key Differences Between a Pay Stub Sample Template and a Paystub Generator

FeaturePay Stub Sample TemplatePaystub GeneratorCustomizationHigh (Can be modified manually)Low to Medium (Depends on generator options)Ease of UseRequires manual entryFully automated and user-friendlyAccuracyDepends on user calculationsHigh (Automated calculations)CostFree or low costOften requires payment or subscriptionTime EfficiencyTime-consumingQuick and efficientSecurityData stored locallyMust ensure secure online platform

Which One Should You Choose?

The best choice depends on your specific needs and business size.

Choose a Pay Stub Sample Template If:

You have a small business or are self-employed.

You are comfortable doing payroll calculations manually.

You prefer free or low-cost solutions.

You need full control over the design and format of your pay stubs.

Choose a Paystub Generator If:

You want to save time and automate calculations.

You need an easy-to-use solution with professional formatting.

Your business has multiple employees and requires frequent pay stub generation.

You want to reduce errors and ensure payroll accuracy.

Conclusion

Both pay stub sample templates and paystub generators offer benefits for businesses and individuals needing to document payroll. If you prioritize cost and customization, a pay stub sample template may be the right choice. However, if you need speed, accuracy, and convenience, a paystub generator is the better option.

Ultimately, the best solution depends on your business size, budget, and payroll processing needs. Whichever option you choose, ensuring that your pay stubs are accurate and professional is essential for maintaining financial transparency and compliance.

0 notes

Text

Free Check Stubs Maker vs. Paid Software: Which is the Better Option?

When it comes to generating pay stubs or check stubs, both business owners and employees look for the easiest and most reliable solution. Fortunately, there are many options available, ranging from free check stubs makers to premium paid software. Each has its own advantages and drawbacks, and the choice depends on several factors such as cost, features, and convenience.

In this blog post, we’ll explore the pros and cons of free check stub makers and paid software to help you decide which one is the best fit for your needs.

What Is a Check Stub?

A check stub, or pay stub, is a document that accompanies an employee’s paycheck. It provides detailed information about the employee's earnings and deductions. The stub typically includes:

Gross earnings: Total income before taxes.

Deductions: Taxes, insurance, retirement contributions, and other deductions.

Net pay: The amount the employee takes home after deductions.

Pay period: The timeframe for which the paycheck is issued.

Check stubs are essential for both employees and employers. Employees use them for budgeting, tax filing, and loan applications, while employers need them for record-keeping and compliance with labor laws.

Free Check Stub Makers: An Overview

Free check stub makers are online tools that allow users to create pay stubs without any cost. These platforms typically offer basic features such as the ability to input payroll details and generate a simple pay stub in a printable format.

Pros of Free Check Stub Makers

Zero Cost The most obvious advantage of free check stub makers is that they don’t cost anything to use. This makes them an ideal choice for individuals or small businesses who have tight budgets but still need professional-looking pay stubs.

Ease of Use Most free check stub creators are user-friendly and require no prior accounting knowledge. Users typically only need to input a few key details, such as the employee’s hourly rate or salary, hours worked, and deductions.

Quick Results Free tools can generate pay stubs quickly. Once the information is entered, the platform will produce the check stub within a matter of minutes.

No Installation Required Since many free check stub creators are online tools, there’s no need to download or install anything on your computer. You can access the platform from any device with an internet connection.

Cons of Free Check Stub Makers

Limited Features Free check stub makers often come with limited customization options. The templates may be basic, and there may not be many fields for additional deductions or allowances. This can be problematic for businesses with complex payroll systems.

Lack of Security Some free tools don’t provide robust security measures for the data you enter. This could lead to potential data breaches, especially if you’re dealing with sensitive payroll information.

Inconsistent Quality The quality of the generated pay stubs may not always meet professional standards. While free tools can produce functional pay stubs, they may not have the polished look that businesses expect when presenting financial documents.

Limited Customer Support Free tools typically do not offer customer support. If you encounter an issue or need help with the tool, you may have to rely on community forums or FAQs for assistance.

Paid Check Stub Software: An Overview

Paid check stub software is a more comprehensive solution that typically offers advanced features and a higher level of customization. These software packages often include additional payroll management tools and support.

Pros of Paid Check Stub Software

Advanced Features Paid software often comes with more robust features than free tools. You can generate pay stubs with complex deductions, benefits, and bonuses, which is especially helpful for larger companies or businesses with unique payroll requirements.

Customization Options Paid software allows users to customize pay stubs in terms of branding, font styles, logos, and more. This is important for businesses that need to maintain a professional image in their financial documents.

Higher Security Paid platforms usually have stronger security measures in place, including encryption, to protect sensitive employee data. This is crucial for businesses that need to comply with data protection regulations such as GDPR or HIPAA.

Customer Support With a paid solution, users typically have access to customer support via email, chat, or phone. This can be invaluable if you encounter any issues or need assistance with complex payroll scenarios.

Integration with Payroll Systems Many paid check stub software options integrate with existing payroll systems, accounting software, or time-tracking tools. This seamless integration can save time and reduce the risk of errors when generating pay stubs.

Compliance Features Paid software often includes compliance features, ensuring that your pay stubs meet local, state, and federal regulations. This can be particularly important for businesses in industries with strict payroll laws.

Cons of Paid Check Stub Software

Upfront Costs The most significant downside of paid software is the cost. While the price can vary, you can expect to pay anywhere from $10 to $50 per month or more. For small businesses or individuals, this may seem like an unnecessary expense.

Learning Curve Paid software can be more complex than free check stub makers. There may be a learning curve, especially for those who are not familiar with payroll processes or accounting software.

Ongoing Subscription Fees Most paid software operates on a subscription model, which means that you will need to pay a recurring fee to continue using the service. This adds up over time, which might be a concern for some users.

Overkill for Small Needs If you only need to create a pay stub occasionally or for a small team, the advanced features of paid software may be unnecessary. In these cases, the simplicity of a free check stub maker might be sufficient.

Which Option Is Right for You?

The choice between a free check stub maker and paid software depends on several factors, including your specific needs, budget, and business size. Below are some key points to consider when making your decision:

When to Choose a Free Check Stub Maker

Limited Budget: If you're an individual or a small business with a tight budget, a free check stub maker can meet your needs without any additional cost.

Basic Requirements: If you only need to create simple pay stubs without complex deductions or additional features, a free tool is probably sufficient.

Occasional Use: If you only need to create a pay stub occasionally, the quick and easy nature of a free tool might be the best option.

When to Choose Paid Software

Large or Growing Business: For businesses with multiple employees, complex payroll systems, or specific regulatory requirements, paid software offers more functionality and reliability.

Customization Needs: If you need to brand your pay stubs or include detailed deductions and benefits, paid software will give you more flexibility.

Security and Compliance: If data security or regulatory compliance is a concern, investing in paid software is the safer option.

Conclusion

Both free check stub makers and paid software have their place depending on the needs of the user. Free tools are great for individuals or small businesses with basic payroll needs, while paid software is better suited for those who need advanced features, security, and customization options.

If you’re just starting out or only need to generate pay stubs occasionally, a free check stub maker may be the most cost-effective and convenient solution. However, if you run a larger business or require more complex payroll management, investing in paid software could save you time, money, and headaches in the long run. Ultimately, the decision comes down to your specific needs, budget, and the level of professionalism you require in your pay stubs.

0 notes

Text

Check Stub Maker: A Budget-Friendly Solution for Modern Businesses

You know what; Check Stub Maker is a software or tool that allows your business to create accurate pay stubs for employees. You can ensure professionalism by sharing it. Undoubtedly, it’s a digital solution that is designed to simplify the payroll process by providing customizable templates.

#Check Stub Maker#Check Stubs#How to Make Check Stubs#Direct Deposit Check Stub#Salary Slip Generator#Salaried Pay Stub#Payroll Generator#Paycheck Now

0 notes

Text

Step-by-Step Guide to Using a Free Paystub Maker

Managing finances effectively is crucial whether you are an employer, employee, or self-employed. One essential financial document that everyone needs is a pay stub. A pay stub provides a detailed breakdown of an employee’s earnings and deductions for a specific pay period. While traditionally offered by employers, there are instances where you might need to create one yourself. This is where a free paystub maker comes in handy.

This guide will walk you through using a free paystub maker step-by-step, ensuring your financial records are accurate and professional.

youtube

What is a pay stub?

Before diving into the step-by-step process, let’s understand what a pay stub is. A pay stub, also known as a paycheck stub, is a document that outlines an employee’s earnings and deductions over a specific period. It includes details like gross wages, net pay, taxes, insurance deductions, and other withholdings. Paystubs are essential for both employers and employees as they provide proof of income, help track earnings, and are often required for tax filings, loan applications, and other financial transactions.

Why Use a Free Paystub Maker?

A free paystub maker simplifies the process of creating a professional-looking paystub without the need for expensive software or accounting services.

Here are some key benefits:

Cost-Effective: As the name suggests, a free paystub maker doesn’t require any investment, making it a budget-friendly option.

User-Friendly: Most free paystub makers are designed with ease of use in mind, requiring minimal technical skills.

Time-Saving: Creating a paystub manually can be time-consuming. A free paystub maker streamlines the process, allowing you to generate a paystub in minutes.

Accuracy: These tools are programmed to handle calculations, ensuring accurate results and reducing the risk of errors.

Now, let’s dive into the step-by-step process of using a free paystub maker.

Step 1: Choose the Right Free Paystub Maker

The first step in creating a paystub is selecting the right free paystub maker. There are several online tools available, each with unique features and user interfaces.

When choosing a paystub maker, consider the following factors:

Ease of Use: The tool should have a user-friendly interface that is easy to navigate, even for those with limited technical skills.

Customization Options: Look for a tool that allows customization, such as adding a company logo, choosing different templates, and inputting specific details.

Security: Ensure the tool you select is secure and respects your privacy, especially when inputting sensitive financial information.

Reviews and Ratings: Check user reviews and ratings to gauge the tool’s reliability and effectiveness.

After evaluating these factors, select a paystub maker that meets your needs.

Step 2: Gather Necessary Information

Before you start creating a pay stub, gather all the necessary information. Having this information ready will make the process smoother and quicker.

Here’s what you typically need:

Employer Information: Company name, address, and contact details.

Employee Information: Employee’s full name, address, Social Security number, and employee ID (if applicable).

Income Details: Gross wages, hourly rate, hours worked, overtime, bonuses, and commissions.

Deductions: Federal and state taxes, Social Security, Medicare, insurance premiums, retirement contributions, and any other deductions.

Pay Period: Start and end dates of the pay period and the pay date.

Step 3: Input the Data into the Paystub Maker

Once you have gathered all the necessary information, it’s time to input it into the free paystub maker.

Here’s how you can do it:

Access the Paystub Maker: Open the website of your chosen paystub maker.

Select a Template: Most paystub makers offer various templates. Choose one that suits your needs. Some templates are designed for specific industries, while others are more general.

Enter Employer Details: Fill in the company name, address, and contact details.

Enter Employee Details: Input the employee’s full name, address, and Social Security number.

Add Income Information: Enter the gross wages, hourly rate, and hours worked. Include any overtime, bonuses, or commissions if applicable.

Input Deductions: Enter all necessary deductions, including federal and state taxes, Social Security, Medicare, insurance premiums, retirement contributions, and any other specific deductions.

Set Pay Period: Indicate the start and end dates of the pay period and the actual pay date.

Review and Verify: Before finalizing, review all the information for accuracy. Ensure that all numbers are correct and that there are no spelling errors.

youtube

Step 4: Generate and Download the Paystub

After inputting all the necessary information, the next step is to generate the pay stub. Most free paystub makers have a “Generate�� or “Create Paystub” button. Click this button, and the tool will automatically calculate the totals and deductions, generating a professional-looking pay stub.

Once generated, you will have the option to preview the pay stub. Please review it carefully to ensure all information is accurate and presented correctly. If everything looks good, you can download the pay stub in your preferred format, typically PDF or Excel.

Step 5: Print or Share the Paystub

After downloading the paystub, you can either print it or share it digitally, depending on your needs. If you are an employer, you can provide the paystub to your employees either as a printed document or via email. If you are self-employed or need the paystub for personal records, you can store it digitally or print it out for your files.

Step 6: Keep Records for Future Reference

It’s essential to keep a record of all pay stubs for future reference. Paystubs serve as proof of income and are often required for tax filings, loan applications, and other financial transactions. Make sure to store them securely, either digitally or in a physical filing system.

Tips for Using a Free Paystub Maker Effectively

Double-Check All Information: Accuracy is critical when creating a pay stub. Double-check all information to avoid errors.

Keep Up-to-Date with Tax Laws: Tax laws and regulations can change, affecting deductions and net pay. Ensure you are up-to-date with current tax laws.

Use a Secure Internet Connection: When inputting sensitive information, always use a secure Internet connection to protect your data.

Conclusion

Using a free paystub maker is a convenient, cost-effective solution for creating professional paystubs. By following this step-by-step guide, you can quickly generate accurate and professional paystubs in just a few minutes. Whether you are an employer, employee, or self-employed, maintaining accurate financial records is essential for your financial well-being. A paystub maker is a valuable tool that helps you achieve this with ease and accuracy. Start using a free paystub maker today and take control of your financial records!

#paystub#paystubs#paystubservice#paystubsneeded#checkstub#checkstubs#checkstubsneeded#paycheck#paychecktopaycheck#paychecks#Youtube

0 notes

Text

Why Every Small Business Needs a Paystub Generator

In today’s fast-paced business environment, efficiency and accuracy in financial management are crucial, especially for small businesses. One of the most critical aspects of financial management is payroll processing. This task, if done manually, can be time-consuming, prone to errors, and challenging to manage as the business grows. This is where a paystub generator becomes an invaluable tool. In this blog, we will explore why every small business needs a paystub generator and how it can benefit from free paystub generator options, check stub makers, and pay stub creators available in the market.

Streamlining Payroll Processing

Manual payroll processing involves calculating employee wages, deducting taxes, and generating paystubs—a task that can be quite labor-intensive. A paystub generator simplifies this process by automating calculations and generating accurate paystubs within minutes. This not only saves time but also minimizes the risk of human error, ensuring that employees receive the correct amount of pay and deductions.

Using a Free Paystub Generator

One of the primary concerns for small businesses is cost. Investing in expensive payroll software might not be feasible for every small business. Thankfully, there are free paystub generator options available that offer robust features without the hefty price tag. These tools allow businesses to create professional paystubs quickly and efficiently, without incurring additional expenses.

Enhancing Accuracy and Compliance

Accurate payroll processing is essential for maintaining compliance with labor laws and tax regulations. Errors in payroll can lead to significant legal issues, fines, and penalties. A paystub generator ensures accuracy by automatically performing complex calculations and generating detailed paystubs that include all necessary information such as gross pay, deductions, taxes, and net pay.

Check Stub Maker for Accuracy

A check stub maker is a specialized tool designed to create detailed and accurate paystubs. These tools often come with templates that comply with legal requirements, ensuring that all necessary details are included. By using a check stub maker, small businesses can avoid costly mistakes and ensure compliance with regulatory standards.

Improving Employee Satisfaction

Employees rely on their paystubs to understand their earnings and deductions. Providing clear, accurate, and timely paystubs enhances transparency and trust between employers and employees. When employees can easily verify their pay and understand their deductions, it fosters a sense of security and satisfaction.

Paystub Generator Free Options

Offering employees detailed and professional paystubs doesn’t have to be expensive. There are paystub generator free options available that allow small businesses to produce high-quality paystubs without incurring additional costs. These free tools can generate paystubs that look professional and include all necessary details, contributing to employee satisfaction.

Facilitating Financial Planning and Record-Keeping

Paystubs serve as essential documents for both employers and employees. They provide a detailed record of earnings, deductions, and taxes paid, which is crucial for financial planning and record-keeping. For employers, maintaining accurate payroll records is vital for tax reporting and audits. For employees, paystubs are necessary for personal financial planning, applying for loans, and other financial transactions.

Free Pay Stub Generator for Record-Keeping

A free pay stub generator can help small businesses maintain accurate payroll records without additional expenses. These tools often allow users to save and export paystubs in various formats, making it easy to keep organized records for future reference.

Simplifying Tax Filing

Accurate and detailed paystubs are essential for tax filing. They provide the necessary information for both employers and employees to accurately report income and deductions. A paystub generator simplifies the tax filing process by ensuring that all payroll information is correctly calculated and documented.

Pay Stub Creator Free for Tax Preparation

Using a pay stub creator free tool can significantly simplify tax preparation for small businesses. These tools generate paystubs that include all necessary tax information, making it easier to prepare and file accurate tax returns. This not only saves time but also reduces the risk of errors and potential penalties.

Customization and Professionalism

A paystub generator allows small businesses to customize paystubs to reflect their brand and meet specific needs. Customizable templates enable businesses to add logos, choose different designs, and include specific information relevant to their industry or business model. This level of customization enhances the professionalism of the business and ensures that paystubs are tailored to meet the unique requirements of the company.

Using Free Paystub Generator Tools for Customization

Many free paystub generator tools offer a variety of customization options, allowing small businesses to create professional and branded paystubs without additional costs. These tools typically provide user-friendly interfaces that make it easy to customize paystubs according to the business’s needs.

Conclusion

In conclusion, a paystub generator is an essential tool for every small business. It streamlines payroll processing, enhances accuracy and compliance, improves employee satisfaction, facilitates financial planning and record-keeping, simplifies tax filing, and allows for customization and professionalism. With the availability of free paystub generator options, check stub makers, and pay stub creators, small businesses can access these benefits without incurring additional costs. By leveraging these tools, small businesses can ensure efficient and accurate payroll management, ultimately contributing to their overall success and growth.

FAQs

What is a paystub generator?

A paystub generator is an online tool or software that automates the creation of paystubs for employees. It calculates earnings, deductions, and taxes, and generates detailed paystubs that can be printed or shared electronically.

Why is a paystub generator important for small businesses?

A paystub generator is important for small businesses because it streamlines payroll processing, reduces the risk of errors, ensures compliance with legal requirements, and enhances employee satisfaction by providing accurate and professional paystubs.

Are there free paystub generators available?

Yes, there are several free paystub generators available online. These tools offer basic functionalities to create professional paystubs without any cost, making them ideal for small businesses with limited budgets.

How does a check stub maker differ from a paystub generator?

A check stub maker is essentially the same as a paystub generator. Both terms refer to tools that create detailed and accurate paystubs or check stubs for employees. The terms are often used interchangeably.

What features should I look for in a paystub generator?

When choosing a paystub generator, look for features such as user-friendly interfaces, customizable templates, secure data handling, integration with payroll systems, and the ability to save and export paystubs in various formats.

#paystub generator#paystub creator#free paystub generator#check stub maker#paystub generator free#pay stub generator free#free paystub maker#free pay stub generator#pay stub creator free#paycheck generator free#paycheck stub maker free#free check stub creator#pay stub maker#paycheck stub generator free#simple pay stub generator#create paycheck stub free#free paystub creator

0 notes

Text

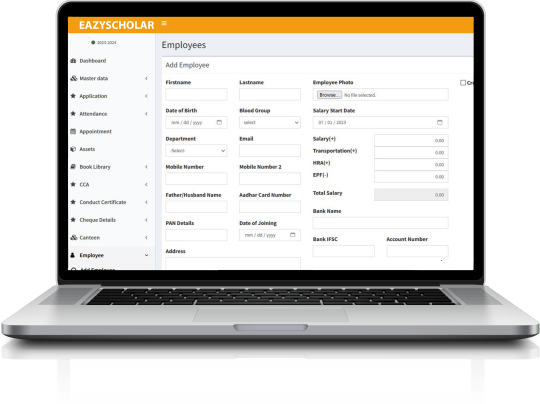

Streamlining Workforce Operations: Exploring the Best Employee Management Software with EazyScholar

Introduction:

In today's dynamic business landscape, managing employees efficiently is crucial for organizational success. Traditional methods of employee management, such as spreadsheets and manual tracking, are becoming outdated and inefficient. This is where employee management software comes into play, offering streamlined solutions for HR tasks, employee engagement, and performance tracking. Among the plethora of options available, EazyScholar stands out as a comprehensive solution tailored to meet the diverse needs of modern businesses. In this comprehensive guide, we will delve into the features, benefits, and advantages of using EazyScholar as the best employee management software.

Understanding the Need for Employee Management Software:

Before diving into the specifics of EazyScholar, it's essential to understand why businesses need employee management software in the first place. With the increasing complexity of workforce management, organizations face numerous challenges, including:

Time-consuming HR tasks: Traditional HR processes are often manual and time-consuming, leading to inefficiencies and errors.

Lack of employee engagement: Engaging and retaining top talent is essential for organizational growth, but without the right tools, it can be challenging to foster a positive work environment.

Performance tracking: Monitoring employee performance and providing timely feedback is crucial for driving productivity and achieving business goals.

Compliance and regulatory requirements: Businesses must comply with various labor laws and regulations, which can be complex and challenging to navigate without proper software solutions.

Some of the key features of EazyScholar include:

Employee Database Management: EazyScholar provides a centralized database for storing employee information, including personal details, contact information, employment history, and performance records. This eliminates the need for manual record-keeping and ensures data accuracy and security.

Attendance Tracking: With EazyScholar, businesses can easily track employee attendance, including clock-in/out times, leave requests, and overtime hours. The software offers flexible scheduling options and automated notifications to ensure smooth workforce management.

Performance Evaluation: EazyScholar simplifies the performance evaluation process by providing customizable assessment templates, goal-setting tools, and performance tracking metrics. Managers can easily monitor employee progress, provide feedback, and identify areas for improvement.

Employee Self-Service Portal: EazyScholar offers an intuitive self-service portal where employees can access their personal information, submit leave requests, view pay stubs, and participate in performance reviews. This empowers employees to take control of their own HR-related tasks, reducing the administrative burden on HR staff.

Recruitment and Onboarding: EazyScholar streamlines the recruitment and onboarding process with features such as job posting, applicant tracking, interview scheduling, and new hire documentation management. This ensures a seamless transition for new employees and improves overall efficiency in the hiring process.

Training and Development: EazyScholar facilitates employee training and development initiatives with built-in learning management features. Businesses can create and deliver training courses, track employee progress, and assess learning outcomes to foster continuous growth and skill development.

Some of the key benefits include:

Increased Efficiency: By automating repetitive HR tasks and streamlining workflow processes, EazyScholar helps businesses save time and resources, allowing HR teams to focus on more strategic initiatives.

Improved Employee Engagement: EazyScholar promotes employee engagement by providing tools for communication, feedback, and recognition. This leads to higher job satisfaction, increased productivity, and reduced turnover rates.

Enhanced Compliance: EazyScholar helps businesses stay compliant with labor laws and regulations by providing built-in compliance tools, automated reporting features, and audit trails for tracking changes to employee records.

Better Decision-Making: With access to real-time data and analytics, managers can make informed decisions about workforce planning, performance management, and talent development, leading to improved business outcomes.

Cost Savings: By eliminating manual processes, reducing errors, and optimizing resource allocation, EazyScholar helps businesses save money in the long run, resulting in a positive return on investment.

Scalability: EazyScholar is highly scalable and can adapt to the evolving needs of growing businesses. Whether you have ten employees or ten thousand, EazyScholar can accommodate your workforce management needs with ease.

Conclusion:

In conclusion, EazyScholar emerges as the best employee management software, offering a comprehensive solution for businesses looking to streamline their HR processes, enhance employee engagement, and drive organizational success. With its robust features, user-friendly interface, and proven benefits, EazyScholar is the ideal choice for modern businesses seeking to optimize their workforce operations. Whether you're a small startup or a large enterprise, EazyScholar can help you unlock the full potential of your workforce and achieve your business objectives with ease. Learn more.

0 notes

Text

Part II, Day 14

You’ve onboarded. But have you ever OFFBOARDED?

Remember the onboarding experience at your last job? All of the paperwork and forms and signups? Insurance, 401k, contracts, agreements, disclosures, direct deposit, etc.

And then there’s at least one new system to learn. Maybe you spent time in Github before, and now things happen in Jira. There’s probably a sizable intranet with all of the answers and a search engine that almost powers it. File structures and Figma templates. On and on.

Onboarding takes a minute, even before you start training or a project.

But if you’ve been part of a layoff recently (and many of us have), you know how much is involved in the OFFboarding process.

As soon as your system access shuts down, the offboarding starts up. Documents will come your way while you are still in a daze. Severance details, a separation agreement, and instructions on how to access things with your new status as a former employee.

After you’ve reviewed the initial wave of documents, other tasks pop up. You'll file for unemployment with your state, just in case, which sometimes results in five separate envelopes arriving in your mailbox at once a few days later. (As pictured.)

Maybe you'll move your 401k to where you have the rest of your finances. If you have RSU or stock options, you have some decisions to make.

Health insurance coverage varies: do you get on your partner’s plan, buy coverage through your state marketplace or elect to use COBRA? Gotta get in those FSA receipts. Can I get another pair of glasses before my coverage ends?

You may need to set up external access to view your pay stubs and tax info. You might cry a little, and commiserate with other colleagues in the same situation.

It’s a whirlwind, to say the least. Unbearable at times, really. You’ll probably want a password manager, because you will create all of the logins. Add to it the newfound urgency of finding another job, and the octopus of anxiety will surely be tapping you with a tentacle.

As with most things, the best advice is to make a list, take it slow, and keep at it. Sure, it’s disorienting, and you’ll get to navigate some dreadful user interfaces, but you’ll make it through. If you have any offboarding questions, I’m here for ya!

0 notes

Text

If you’ve been creating paystubs with the usage of manual strategies, like pen and paper spreadsheets or tests, then you are definitely doing it all incorrectly. Payroll is made a great deal less complicated with generation because the giant majority of your responsibilities may be automated using a paystub generator.

0 notes

Text

Modernizing Payroll: The Benefits of Using a Pay Stub Generator with Logo

In today's fast-paced business environment, modernizing processes is essential for staying competitive and efficient. One area that has seen a significant transformation is payroll management, thanks to innovations like the integration of a Pay Stub Generator With Logo. This advancement is revolutionizing how companies manage their payroll systems while offering a range of benefits that extend beyond the mere paycheck.

Branding Beyond Borders

The inclusion of a company logo on pay stubs might seem like a small detail, but it has a substantial impact on brand identity. Each time an employee receives a paycheck stub with the company logo prominently displayed, it reinforces the brand's presence and creates a sense of unity. It's a powerful visual reminder that every payday is connected to the larger purpose and values of the company. This simple addition goes a long way in building a strong corporate identity that resonates with both employees and external stakeholders.

Professionalism in Every Pay Stub

Gone are the days of handwritten paychecks and basic text-based pay stubs. With the availability of advanced check stub makers and pay stub generators, companies can create professional-looking pay stubs online. These platforms allow businesses to add logos, customize fonts, and select color schemes that mirror the company's branding. This attention to detail contributes to an overall sense of professionalism and reliability, helping to foster trust between employers and employees.

Employee Engagement and Satisfaction

Creating pay stubs online using a generator with a logo is not just about delivering accurate financial information; it's also a way to engage and empower employees. A well-designed pay stub, complete with the company logo, shows that the organization values transparency and takes its communication seriously. This proactive approach can enhance employee satisfaction and increase loyalty. Moreover, when employees see their efforts reflected in a professional, branded pay stub, it can boost morale and foster a sense of belonging.

Efficiency and Accuracy

The process of manually creating pay stubs is not only time-consuming but also prone to errors. On the other hand, utilizing a check stub maker or pay stub generator streamlines the process, ensuring accuracy and consistency. Employees can access their pay stubs online, eliminating the need for physical distribution. This reduces the chances of lost or misplaced pay stubs and minimizes potential disputes regarding payment details. The automation provided by a pay stub generator enhances efficiency, freeing up valuable time for HR personnel to focus on more strategic tasks.

Compliance and Record-Keeping

Accurate record-keeping is critical for any business, especially when it comes to payroll. Pay stub generators often come equipped with features that ensure compliance with legal requirements. This includes the inclusion of essential information such as tax deductions, contributions to retirement funds, and other deductions. With the help of a pay stub generator, companies can effortlessly maintain detailed and accurate records that are essential for audits, employee queries, and tax reporting.

Check these :-

Fake W2 Generator

Free Pay Stub Template

Paystub for Self Employed

Accessibility and Convenience

In a digitally connected world, accessibility is key. With the ability to Create Pay Stub Online, both employers and employees can access necessary financial information at any time and from any location. This convenience is particularly advantageous for remote workers or employees who travel frequently. The inclusion of a logo on these online pay stubs ensures that the company's brand is carried with them wherever they go, strengthening the sense of belonging and alignment with the organization.

In conclusion, modernizing payroll by incorporating a pay stub generator with a logo offers a multitude of benefits that go beyond the financial transaction. From reinforcing branding and professionalism to enhancing employee engagement and satisfaction, the impact is far-reaching. With advanced tools like check stub makers and online pay stub generators, businesses can streamline processes, improve accuracy, and provide their employees with a polished, branded representation of their hard-earned income. As technology continues to evolve, leveraging these tools becomes an essential step toward a more efficient and engaging payroll management system.

0 notes

Text

Need a Pay Stub Creator Free of Cost? Here's How to Get One Instantly

Let's face it—whether you're a freelancer, gig worker, or running your own small business, you will need a pay stub at some point. Landlords, lenders, and even some government services ask for them as proof of income. But what if you don't have access to traditional payroll systems?

No worries. Pay stub creator free tools are available online that make it super easy to generate your own stubs—without paying a cent.

Why Create a Pay Stub Yourself?

If you're not getting one from an employer or you're self-employed, creating your paycheck stub can help you:

Show proof of consistent income

Stay organized with your earnings

Manage taxes and deductions

Get approval on rental or loan applications faster

It's beneficial if you're part of the gig economy, work with clients directly, or run a solo business.

What to Look for in a Free Pay Stub Creator

Not all tools that say "free" are free. Many sites will let you fill out your information, only to ask for payment right before download. So when choosing a pay stub creator free, keep this in mind:

Does it let you download or print without charging?

Are the templates clean, professional, and accepted by institutions?

Is the site secure and trustworthy?

Does it calculate taxes and deductions automatically?

How to Make a Pay Stub Online in 2 Minutes

Yes, it's that fast. Just follow these steps:

Go to a site like PayStubGeneratorFree.com

Fill in your business and employee details

Add income and deduction info

Click Generate

Download the stub as a PDF—done

No downloads, no waiting, no payment walls. Super simple.

Final Thoughts

If you're hunting for a pay stub creator free, it's easier than you think. These tools are designed to save you time, money, and stress. Plus, they can be a lifesaver when you need documentation fast and can't wait for an accountant or HR department.

Try out a few and see which one best suits your needs. If you regularly create stubs, consider bookmarking your favorite for future use.

Stay organized. Stay verified. Stay ahead.

Let me know if you want to see a side-by-side comparison of different stub creators or get tips for customizing your stubs like a pro.

Let me know if you want this formatted into a Tumblr draft with tags or a published-style markdown. I can also provide a shorter version for Tumblr captions or mobile blogs.

1 note

·

View note

Text

Managing Multiple Employees Made Easy with a Paystub Creator

Managing a team of employees can be an exciting yet challenging task. One of the most critical responsibilities for any business owner or HR manager is ensuring that employees are paid correctly and on time. While managing employee payroll might seem straightforward at first, as your business grows and you hire more staff, this task can quickly become complex and time-consuming.

That’s where a paystub creator comes in. In this blog, we will explore how using a paystub creator can simplify managing multiple employees, ensuring accurate pay, and saving you time and effort. We’ll discuss how paystub creators work, their benefits, and why they are an essential tool for any growing business in the USA.

What is a Paystub Creator?

A paystub creator is a software tool that helps employers generate pay stubs for their employees. A pay stub (also known as a paycheck stub) is a document provided to employees with their wages. It breaks down how much they earned during the pay period, taxes that were withheld, and other deductions such as benefits or retirement contributions.

With a paystub creator, employers can easily create detailed and accurate pay stubs without the hassle of manual calculations. Whether you’re managing a small business or overseeing a large team of employees, this tool can help streamline your payroll process.

Why is a Paystub Creator Important for Managing Multiple Employees?

As businesses grow and the number of employees increases, managing payroll manually becomes more difficult. A paystub creator offers several benefits that can ease this process, saving time, reducing errors, and ensuring compliance with tax laws. Let’s dive deeper into the reasons why a paystub creator is a game-changer for managing multiple employees.

1. Accuracy and Efficiency

One of the most significant advantages of using a paystub creator is the accuracy it brings to payroll management. Calculating wages manually can lead to mistakes, which can be costly. A paystub creator ensures that all calculations, including overtime, deductions, taxes, and benefits, are handled accurately.

Using automated tools also eliminates the time-consuming process of manually calculating and updating payroll details for each employee. A paystub creator generates pay stubs within minutes, allowing you to spend more time focusing on growing your business instead of being bogged down by administrative tasks.

2. Time-Saving

When you're managing multiple employees, generating pay stubs manually can take a lot of time. For each employee, you’d need to calculate their hours worked, their rate of pay, overtime, and deductions. Additionally, you would have to create a separate pay stub for each employee, which can take hours depending on the size of your workforce.

With a paystub creator, all this is done automatically. You simply input the necessary data, and the paystub creator will quickly generate accurate pay stubs for every employee. This time-saving tool allows you to process payroll faster, which is especially important during busy payroll periods.

3. Compliance with Tax Laws

In the United States, tax laws can be complicated, and failing to comply with federal and state regulations can result in penalties. A paystub creator can help ensure that your pay stubs reflect the correct tax information, such as federal and state tax withholdings, Social Security, and Medicare deductions.

Most paystub creators are designed to keep up with current tax laws, so you don’t have to worry about updating tax rates or deductions manually. By using a paystub creator, you reduce the risk of making costly tax errors and ensure that your business remains compliant.

4. Professional Appearance

When you hand out pay stubs to your employees, having a clean, professional format can make a big difference. A paystub creator provides pre-designed templates that look neat and professional, making it easy to share clear, easy-to-understand pay stubs with employees. These templates also include all the required information, such as the employee’s name, pay period, earnings, deductions, and net pay.

Professional-looking pay stubs help foster a positive work environment and show employees that you care about providing them with detailed and transparent payroll information. It also adds credibility to your business, which is important if you’re working with contractors or freelancers.

5. Customization

Every business has its unique needs, and a paystub creator offers flexibility and customization options to meet those needs. You can easily adjust the pay stub layout to include specific details that are relevant to your business, such as:

Overtime hours and rates

Bonuses or commissions

Deductions for healthcare or retirement plans

Sick and vacation leave balances

This level of customization ensures that every pay stub reflects the most accurate and relevant information for each employee.

6. Record Keeping

Keeping accurate records is crucial for businesses, especially when it comes to employee wages. A paystub creator can automatically store a record of each generated pay stub, allowing you to access past pay stubs quickly. This is beneficial when employees have questions about their earnings or when you need to retrieve pay stub information for tax filing or audits.

Many paystub creators also allow employees to access their pay stubs online, which means they can retrieve their records whenever they need them. This can save you time by reducing the number of inquiries you need to respond to.

7. Employee Satisfaction

When employees receive accurate and transparent pay stubs, it boosts their confidence in your business. A paystub creator helps foster an environment of trust by ensuring employees receive detailed, clear, and error-free pay information. This reduces misunderstandings and payroll disputes, leading to higher employee satisfaction and retention.

Additionally, the convenience of accessing pay stubs online or through an app helps employees stay organized, which can improve their overall experience working for your company.

8. Cost-Effective

Although it may seem like an added expense, investing in a paystub creator can actually save you money in the long run. By automating payroll calculations and eliminating the risk of human errors, you reduce the chances of costly mistakes and tax penalties. Furthermore, the time saved by using a paystub creator allows you to focus on more important aspects of your business.

Many paystub creators offer affordable pricing plans based on the size of your team, making it an accessible tool for both small and large businesses.

How to Choose the Right Paystub Creator

When selecting a paystub creator, there are a few key factors to consider:

1. Ease of Use

Look for a paystub creator that is user-friendly and easy to navigate. The interface should be intuitive, allowing you to create pay stubs quickly without needing to be an expert in payroll or accounting.

2. Customizability

Choose a paystub creator that allows you to customize the pay stubs to fit your business's needs. Look for features such as the ability to add specific deductions, bonuses, or benefits.

3. Security Features

Since pay stubs contain sensitive information, it's essential to select a paystub creator that offers strong security measures. Ensure that the platform uses encryption to protect both employee and company data.

4. Integration with Other Payroll Tools

Some paystub creators integrate with other payroll or accounting software, which can help streamline your business’s financial processes. Consider whether the paystub creator can sync with your current systems.

5. Customer Support

Reliable customer support is vital if you run into issues or need assistance with using the tool. Check for businesses that offer phone, email, or live chat support.

Conclusion

Managing multiple employees doesn’t have to be overwhelming. With the right tools in place, such as a free paystub creator, you can streamline the payroll process and ensure that your employees are paid accurately and on time. From improving accuracy and saving time to ensuring compliance with tax laws and boosting employee satisfaction, the benefits of using a paystub creator are undeniable.

Whether you're running a small startup or overseeing a large team, a paystub creator is an investment that can simplify payroll, reduce errors, and improve efficiency. It’s time to take control of your payroll process and focus on what truly matters—growing your business.

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

Get Pay Stub From Starbucks

How To Get Paystub From Zachary

What Is KMTCHTR on Pay Stub?

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season

What is an eStub and How Does It Simplify Payroll Management?

#check stubs#check stub maker#check stubs maker#paystub creator#paycheck generator#free paystub Maker#free check stub maker#free paystub generator#check stub generator#paycheck generator free

0 notes

Photo

Create pay stub template

https://www.pay-stubs.com/sample-pay-stub/ pay stub template build by trained accountants, ensuring accurate calculations and instant delivery. We have no need of subscription and no need to download software, and no extra hidden fees.

0 notes

Link

We have the solution! You only have to remember that our free paystub maker with a calculator is by your side.

https://stubcreator.com/

#How to access old paystubs#paycheck stubs#check stubs#free pay stub templates#create a pay stub#free paystub maker with a calculator

0 notes

Text

What Does a Pay Stub Look Like?

A pay stub is a crucial document for employees and employers alike. It provides a detailed breakdown of an employee's earnings and deductions for a specific pay period. If you're wondering what a pay stub looks like, this blog will walk you through its key components. Plus, we'll introduce you to "Online Paystub," your go-to solution for creating professional pay stubs effortlessly. Whether you need a free paystub generator, a check stub maker, or any other paycheck stubs generator, Online Paystub has got you covered!

Key Components of a Pay Stub

Employee Information

Name

Address

Employee ID or Social Security Number

Employer Information

Company Name

Company Address

Employer Identification Number (EIN)

Pay Period

Start Date

End Date

Earnings

Regular Hours Worked

Overtime Hours Worked

Gross Pay (Total earnings before deductions)

Deductions

Federal Tax

State Tax

Social Security

Medicare

Health Insurance

Retirement Contributions

Net Pay

Total amount the employee takes home after all deductions

Why Use Online Paystub?

Creating accurate and professional pay stubs can be a hassle, especially if you're not familiar with the process. That's where Online Paystub comes in. Our platform offers a range of features that make pay stub generation a breeze.

Features of Online Paystub:

Free Paystub Generator: Create professional pay stubs without any cost.

Check Stub Maker: Easily generate detailed check stubs with all necessary information.

Paystub Generator Free: Our free version includes all essential features.

Paycheck Generator Free: Produce accurate paycheck stubs for free.

Free Check Stub Creator: No hidden fees or subscriptions—just straightforward pay stub creation.

Make Paystub Generator: Customize your pay stubs to fit your needs.

Paycheck Stubs Generator: Efficiently manage payroll for your employees.

Stub Generator: Simple, fast, and reliable stub generation.

How to Create a Pay Stub with Online Paystub

Visit Our Website: Go to the Online Paystub website.

Select a Template: Choose from various professional templates.

Enter Information: Fill in the necessary employee, employer, and earnings details.

Preview and Edit: Review the pay stub and make any necessary adjustments.

Download or Print: Once you're satisfied, download the pay stub or print it directly.

Benefits of Using Online Paystub

Time-Saving: No need to spend hours manually creating pay stubs.

Accuracy: Ensures all calculations are correct, avoiding errors in your payroll.

Professional Appearance: Our templates give your pay stubs a polished, professional look.

Convenience: Generate pay stubs anytime, anywhere, from any device.

Conclusion

Understanding what a pay stub looks like is essential for both employees and employers. It provides a transparent view of earnings and deductions, helping to manage finances better. With Online Paystub, creating pay stubs has never been easier. Whether you're looking for a free paystub generator, a check stub maker, or any other stub generator, our platform offers all the tools you need. Try Online Paystub today and experience the convenience of professional pay stub generation at your fingertips!

#free paystub generator#check stub maker#paystub generator free#paycheck generator free#free check stub creator#make paystub generator#paycheck stubs generator#stub generator

0 notes

Text

Free Check Stub Templates – How to use?

Using a Free check stub template is a perk savored by those who use paystub maker tools online. It is not be mentioned that the default templates are already neat and clean

but if you wish to customize your paycheck stubs online then what else could be better than using templates.

Before knowing the usage, you should know “when” to use them.

When to use free pay stub templates?

Whenever you want to create personalized paychecks, you may use free pay stub templates. No matter if you are a freelancer, small or large business owner, you may want to categorize particular paychecks and by spending less to no amount, you avail this feature online.

New User Offer: Get $4.99 OFF on your 1st online pay stub order

Many firms opt to classify paychecks for contractors and employees by choosing different paychecks design for both of them. You may try this too.

Using Basic to Advance Check Stub Template Designs

Be exposed to innumerable basic to advance check stub template designs and apply them from the same screen that you use to create paystubs. You don’t have to move elsewhere and see the list of templates available.

As you shift your choice from basic to premium, you may have to pay a few dollars. That’s very affordable as compared to the cost you pay when you outsource the same. Any payroll software will hardly facilitate this.

Using a check stub template with Pay stub generator is too easy-breezy and you’ll get this as you make one.

So, what are you waiting for? Use the Paystub generator now!

#Free Check Stub Templates#free pay stub templates#online pay stub#Check Stub Template#Pay stub generator#Paystub generator#paycheck stubs#paystub maker

1 note

·

View note

Text

I couldn't calculate the taxes on pay stubs for employees until I found this.

Hello all! I'm Ronald, a small business owner. I know that generating pay stubs can be a time-consuming and tedious task. It’s not only about formatting the pay stubs but also calculating employee taxes accurately, including federal, state, and local taxes.

I used Excel to generate pay stubs for my employees, but it was error-prone. I would often make mistakes when calculating the taxes, and I would have to spend more time and energy correcting them.

I also found that the pay stubs were not formatted very well, and they looked unprofessional. It often gives headaches while touching this part.

I recently switched to SecurePayStubs, and I'm so glad I did!

SecurePayStubs is an online pay stub generator that makes it easy to create accurate and professional-looking pay stubs.

Here are some of the things I love about SecurePayStubs:

It's easy to use. The user interface is very user-friendly, and I was able to create my first pay stub in just a few minutes. It's accurate. SecurePayStubs uses the latest tax laws to calculate the correct taxes for each employee. I've never had to worry about making a mistake with the taxes. It's professional. The pay stubs that SecurePayStubs generates are formatted beautifully and look just like those I used to get from my previous employer.

If you're a small business owner who is looking for an easy, accurate, and professional way to generate pay stubs, I highly recommend SecurePayStubs.

It's a great way to save time and money, and it will help you create pay stubs that are accurate and compliant with the latest tax laws.

Here are some additional benefits of using SecurePayStubs:

Create pay stubs for any employee, regardless of their location. Securely store your pay stubs and access them on the go. Access a library of free professional-looking paystub templates. Calculate federal and all 50 state taxes based on current tax laws and requirements. Includes other customization options, such as including employees’ time-off information and deposit slip on pay stubs.

If you're looking for a reliable and affordable way to generate pay stubs, I encourage you to try SecurePayStubs. You won't be disappointed.

0 notes